As we have seen in Money, Part 1, prior to the American Revolution various areas of the country used different items as their medium of exchange. In Virginia, the colonists used tobacco. In South Carolina, they used rice. The Spanish silver dollar was also used as a medium of exchange both before and after the Revolutionary War.

The Spanish dollar was widely used by many countries as international currency because of its uniformity in standard and milling characteristics. Some countries countersigned the Spanish dollar so it could be used as their local currency.[1]

The Spanish dollar was the coin upon which the original United States dollar was based, and it remained legal tender in the United States until the Coinage Act of 1857.

A crisis arose during the Revolutionary War. Wars are expensive to fight, and the American colonies didn’t have enough Spanish silver dollars to pay everyone. The solution was to issue paper currency backed by nothing of value. These ‘Continentals’ were used to fund the war, but after the war they became worthless.

Most colonial notes were “bills of credit” notes meant to be redeemable in coin. Colonial paper money rarely lasted very long because the colonies generally issued too much of it and the resulting inflation made the bills worthless. Thus the term “not worth a Continental.”

After the Revolutionary War, there was a period of time when both the federal government and the individual state governments had the power to coin their own money. The Articles of Confederation limited the federal government’s power to regulating the composition of coins and their value:

The United States in Congress assembled shall also have the sole and exclusive right and power of regulating the alloy and value of coin struck by their own authority, or by that of the respective States…

This arrangement continued until the Constitution was ratified in 1788. Article I Section 8 gave Congress the power to coin money and regulate the value of these coins. Section 8 also gave Congress the power to borrow money on the credit of the United States. In Article I Section 10, the Constitution prohibited the states from coining money and from “making anything but gold and silver coin a tender in payment of debts.”

In 1792, Congress passed the Coinage Act. Under this Act, the federal government

adopted the decimal system, and combined Alexander Hamilton’s idea of a bimetallic standard with Thomas Jefferson’s proposal that the dollar be the standard unit of money. The denominations prescribed for silver coins were to be a half dime, dime, quarter dollar, half dollar and dollar. Denominations for gold coins were to be a quarter eagle ($2.50), half eagle ($5), eagle ($10). Congress also provided for the coining of copper cents and half cents but did not give copper legal tender status, therefore copper could be refused as payment.

A bimetallic standard means that there are two valuable metals being minted into coins for use in exchange. The Coinage Act of 1792 defined a dollar as 371 4/16 grain (24.1 g) pure or 416 grain (27.0 g) standard silver, and set the value of silver and gold as

15 units of pure silver equivalent to 1 unit of pure gold. Standard gold was defined as 11 parts pure gold to one part alloy composed of silver and copper. Standard silver was defined as 1485 parts pure silver to 179 parts copper alloy. The Act also specified the dollar as the “money of account” of the United States, and directed that all accounts of the federal government be kept in dollars.

Early coins fell into these 3 categories:

Copper Coinage

The one-cent piece, the Large Cent was first struck in 1792. Almost as large as our present day half dollar, it was also unpopular, cumbersome and awkward to use as change. The coin was produced with a low-grade copper and was of poor quality. The Large Cent was produced until 1857, when it was replaced by a much smaller coin.

Silver Coinage

Coinage of silver began in 1794 and only the half dollar and the dollar were struck consistently; smaller denominations were coined only on demand of depositors. The earliest U.S. silver coins are identical in design and bear no mark of denomination; only their size distinguishes their value.

The first quarter was not struck until 1796 and for several years at a time none were coined.

Gold Coinage

The half eagle (five dollar piece) first struck in 1795, dominated early gold coinage and for several years it was one of the few coins the Mint issued in gold.

Thus, the early United States had three types of coins in circulation: copper coins, silver coins, and gold coins. This is why today’s pennies have a copperish look, while nickels, dimes, and quarters have a silverish look.

For the most part, from 1792 until 1933 the United States was on a bimetallic standard with both gold and silver coins in circulation. The one exception was during the Civil War, when both sides printed paper money to finance their expenses. The Union issued greenbacks, while the Confederacy issued Confederate dollars. Not long after the war ended, both greenbacks and Confederate dollars were worthless because both governments had printed so many of them that their value was driven to zero.

One drawback of having a bimetallic monetary standard is that you need to have gold and silver coins in circulation. And you have to carry them around when you want to make a purchase. Imagine having 100 of these in your pocket:

Trust me, 1 ounce of silver is heavy. And gold is even heavier. Another worry with metal coins is that someone will see the bulge in your pocket, follow you, and rob you. Government came up with silver and gold certificates to get around this problem.

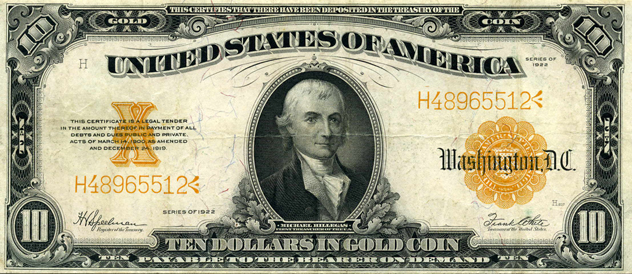

There are a few of things worth noting here.

- These are not Federal Reserve Notes. These certificates were issued by the U.S. Treasury Department, not the central bank.

- These notes certify that “there has been deposited in the Treasury of the United States of America” the corresponding amount of silver or gold. In other words, before the U.S. Treasury could print up more of these certificates, they had to actually have more silver and gold in their possession. This is one great benefit of a commodity-backed currency: the government cannot simply issue more money than it holds as gold and silver. Thus, inflation is kept low.

- If a person had one of these certificates, he could take it into a bank and demand the face value in gold or silver. And the bank had to give it to him!

Sadly, the U.S. Mint no longer produces coins with copper, silver, or gold content.* And our paper money is no longer produced by the U.S. government at all. Federal Reserve Notes are produced by the Federal Reserve System, and have nothing backing them but the “full faith and credit of the United States”. I will discuss what this means in Part 3 later this week.

So how did we go from a bimetallic silver-and-gold standard to the Federal Reserve Note standard?

The End of Gold

The United States officially moved from a bimetallic standard to a gold standard with the passage of the Gold Standard Act of 1900. This Act made gold the only standard for redeeming money:

The Act made the de facto gold standard in place since the Coinage Act of 1873 (whereby debt holders could demand reimbursement in whatever metal was preferred–usually gold) a de jure gold standard alongside other major European powers at the time.

The Act fixed the value of the dollar at 25 8⁄10 grains of gold at “nine-tenths fine” (90% purity), equivalent to 23.22 grains (1.5046 grams) of pure gold.

The Gold Standard Act confirmed the United States’ commitment to the gold standard by assigning gold a specific dollar value (just over $20.67 per Troy ounce).

The United States remained on the gold standard until the election of Franklin Delano Roosevelt. On March 6, 1933, FDR declared a ‘banking holiday’. Banks were closed for an entire week:

At 1:00 a.m. on Monday, March 6, President Roosevelt issued Proclamation 2039 ordering the suspension of all banking transactions, effective immediately. He had taken the oath of office only thirty-six hours earlier.

The terms of the presidential proclamation specified that “no such banking institution or branch shall pay out, export, earmark, or permit the withdrawal or transfer in any manner or by any device whatsoever, of any gold or silver coin or bullion or currency or take any other action which might facilitate the hoarding thereof; nor shall any such banking institution or branch pay out deposits, make loans or discounts, deal in foreign exchange, transfer credits from the United States to any place abroad, or transact any other banking business whatsoever.”

For an entire week, Americans would have no access to banks or banking services. They could not withdraw or transfer their money, nor could they make deposits.

Once the banks were closed, the politicians went to work. Congress passed the Emergency Banking Act, which

- expanded the powers of the president during a banking crisis, including retroactive approval of the banking holiday and regulation of all banking functions, including any transactions in foreign exchange, transfers of credit between or payments by banking institutions as defined by the President, and export, hoarding, melting, or earmarking of gold or silver coin.

- gave the Comptroller of the Currency the power to restrict the operations of a bank with impaired assets and to appoint a conservator, who shall take possession of the books, records, and assets of every description of such bank, and take such action as may be necessary to conserve the assets of such bank pending further disposition of its business.

- gave the Secretary of the Treasury the power to determine whether a bank needed additional funds to operate and with the approval of the President request the Reconstruction Finance Corporation to subscribe to the preferred stock in such association, State bank or trust company, or to make loans secured by such stock as collateral.

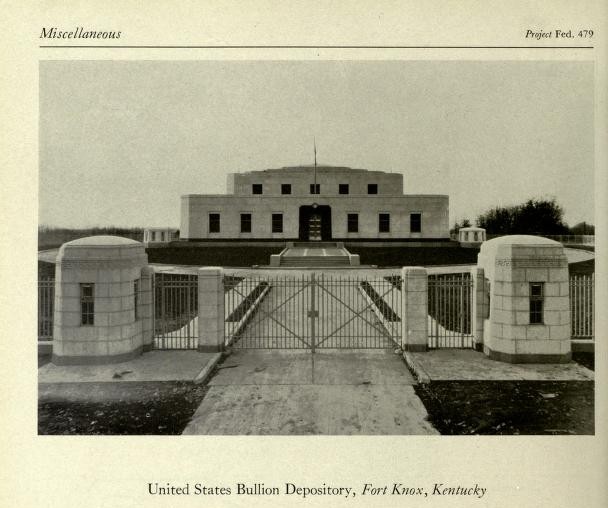

On April 5, 1933 President Roosevelt signed Executive Order 6102. This Executive Order outlawed the Hoarding of gold coin, gold bullion, and gold certificates within the continental United States”. It criminalized the possession of monetary gold by any individual, partnership, association or corporation. U.S. citizens were ordered to turn in all gold coins and gold certificates to their bank. The gold certificates were destroyed, while the gold coins were melted down, formed into ingots, and sent to Fort Knox, Kentucky. Citizens who refused to comply were threatened with punishment of 10 years in prison and a $10,000 fine (equivalent to over $183,000 in today’s dollars).

Once citizens had turned in their gold for $20.67 per ounce, FDR ‘revalued’ gold by declaring that one ounce of gold was now worth $35 per ounce. This simple action resulted in a $2.8 billion windfall for the federal government (i.e., they now had $2.8 billion more to spend on the New Deal). While U.S. citizens could no longer own gold, foreigners could still exchange their dollars for gold. Aside from amounts that were held as jewelry, all of the gold in the country was now held in Fort Knox.

At least, that’s what we are told. Rumors abound that the gold that is supposed to be in Fort Knox is gone. No one really knows if these rumors are true or not, as the gold hasn’t been seen since 1978 when a small group (including Ron Paul) were allowed to see the gold.

The last audit was around 1978 and allegedly only accounted for 11 percent of the presumed gold in Fort Knox per David P. Sorando of the United States General Accounting Office; eye witnesses report seeing what might have been copper content within the gold per Lew Rockwell.

To add to the mystery, in his book The Power of Gold author Peter L. Bernstein relates how he was determined to debunk this conspiracy theory. He contacted the proper authorities and requested to see the gold. All he wanted them to do was open the vault and let him peek in. He was told that “Fort Knox is an Army base, and no visitors are allowed.” So no one really knows if the gold is still there or not.

The End of Silver

While gold was removed from circulation in 1933, silver coins and silver certificates remained in circulation until 1964 when the government ended their production.

“If we had not done so, we would have risked chronic coin shortages in the very near future.” President Lyndon Johnson commented before Congress just prior to his signing the Coinage Act of 1965, the law which fundamentally changed the composition of America’s coinage. The new Act set the stage for the complete abandonment of the use of silver for U.S. legal tender coins – the custom which Americans had been used to since the original Coinage Act of 1792, signed by President Washington.

FDR had nationalized the nation’s silver supply when he issued Executive Order 6814 on August 9, 1934.

On August 9, 1934 U.S. President Franklin D. Roosevelt implemented the seizure of all silver situated in the continental United States with Executive Order 6814 – Requiring the Delivery of All Silver to the United States for Coinage.[1][2][3]

Executive Order 6814 closely mirrors Executive Order 6102, which FDR signed on April 5, 1933, “forbidding the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates within the continental United States” with some differences. A key difference was that EO 6814 excluded the seizure of all silver coins, whether foreign or domestic, while EO 6102 only exempted from seizure certain types of collectible or numismatic coins.

While all gold had been confiscated in 1933, silver coins were still allowed to circulate until the passage of The Coinage Act of 1965.

As a result of the Silver Purchase Act of 1934, President Roosevelt issued Executive Order 6814, nationalizing the nation’s hoard of privately owned non-monetary silver, and prohibiting private ownership of quantities exceeding 500 troy ounces. [2] Any amounts greater than this limit were to be surrendered to the U.S. government in exchange for U.S. silver certificates, minus a seigniorage and manufacturing deduction of 61.32% [3].

Thus, the bimetallic standard of the United States came to an end. The federal government was now free to spend as much as it wanted on the Vietnam War and the Great Society programs of Lyndon B. Johnson. President Nixon severed the final link between the dollar and gold in August of 1971 when he declared that the United States would no longer exchange the dollars held by foreigners for gold.

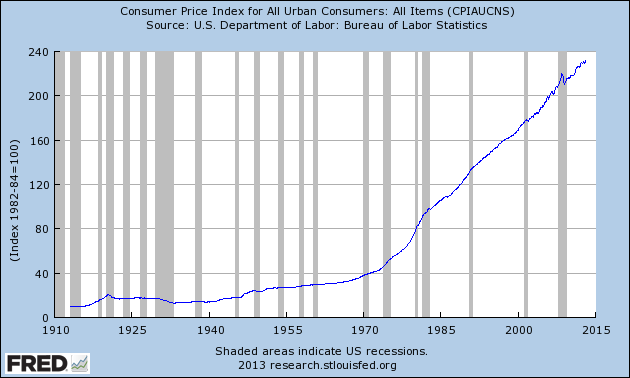

And once unfettered from its gold and silver shackles, the value of the dollar quickly shrank as the central bank printing press went into overdrive.

It seems that J.P. Morgan was right.

- The US Mint does produce Silver Eagles and Gold Eagles. However, these coins are considered bullion and are not legal tender. They do not circulate. Forbes explains why: https://www.forbes.com/sites/realspin/2013/08/21/solving-a-serious-mystery-why-dont-gold-and-silver-coins-circulate/#5371eceb477a

Categories: Money

You must be logged in to post a comment.